Mortgage Equity Partners’

2-1 Buydown Loan Program

Homebuyers:

Take advantage of a 2/1 Buydown today!

Ease your mortgage payment for the first two years with MEP’s 2-1 Buydown Program. Simply stated, the 2-1 buydown program allows you, the borrower, to pay a lower monthly payment for the first 2 years of your mortgage.

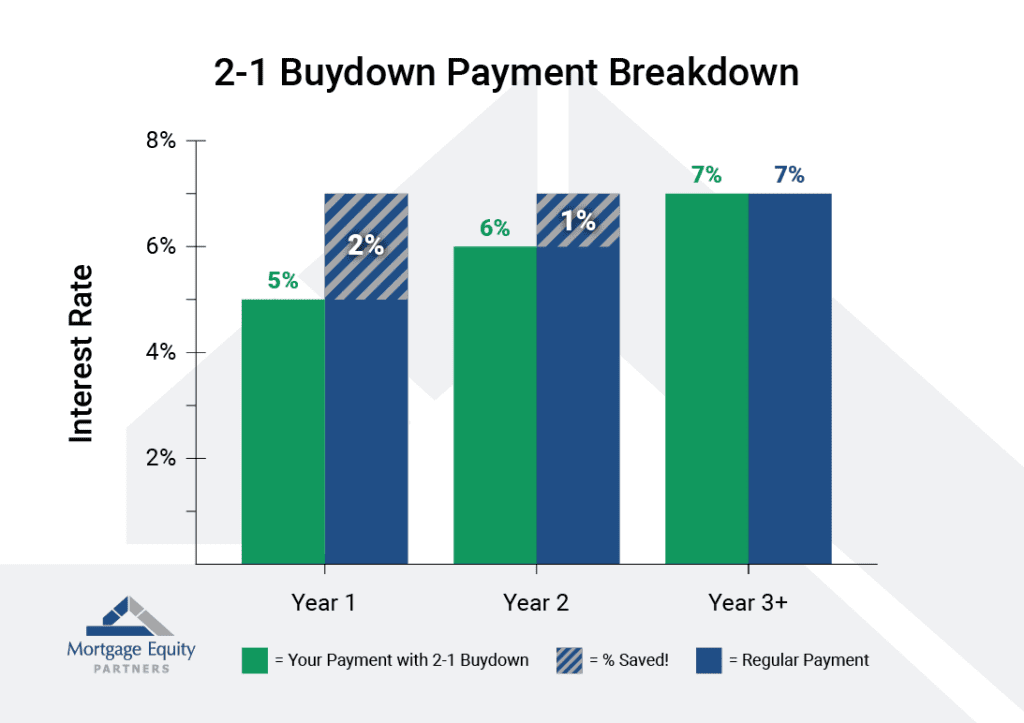

- The first year your payment will be based on 2% below the note rate

- The second year your payment will be based on 1% below the note rate

- The remainder of the term your payment will be based on the note rate

If you are looking to buy a home and need to find a solution to lower your monthly payment, we have the answer!

What is a 2-1 buydown loan?

A 2-1 buydown is a mortgage lending technique that provides for a lower mortgage payment during the first two years of the loan term. In the first year, the principal and interest payment will be based on 2% below the note rate. The principal and interest payment will be based on 1% below the note rate in the second year. For the remainder of the term, the payment will be based on the note rate (the actual interest rate on the loan).

How is this possible?

The buyer, seller, lender, or builder can fund the buydown. In addition, the buydown cost can be split between different parties in the transaction. The funds are collected at closing, placed in an escrow account, and paid monthly to make the full P&I payment at the note rate.

What’s great about this program is that homebuyers can purchase a new home at a more affordable payments giving them two years to make lower mortgage payments and ease into the full payment based on the note rate amount. So essentially, homebuyers will get two years of lower payments.

The buydown program can be used for owner-occupied homes and second homes for purchases and rate and term refinance. However, borrowers cannot get cash out by using this program.

Taking advantage of our 2-1 Buydown Loan Program and Get Started today or call 877-866-4511 to find out if it’s right for you.